-

Call: +91-9840269190

Call: +91-9840269190

-

Mail: hr@voltechgroup.com

Mail: hr@voltechgroup.com

Why Urgent Hiring Fails Even When You Have Candidates Ready & How to Fix It

- Home

- -

- Blog

- By Syari

- Published: 14 February 2026

Quick Verdict: Why Urgent Hiring Fails and How Structured Commitment Systems Fix It

Urgent hiring fails not because staffing agencies lack candidates, but because they lack structured commitment systems between offer acceptance and day-one reporting.

In urgent staffing scenarios, the operational breakdown occurs during the 6–24 hour commitment window between verbal confirmation and physical attendance.

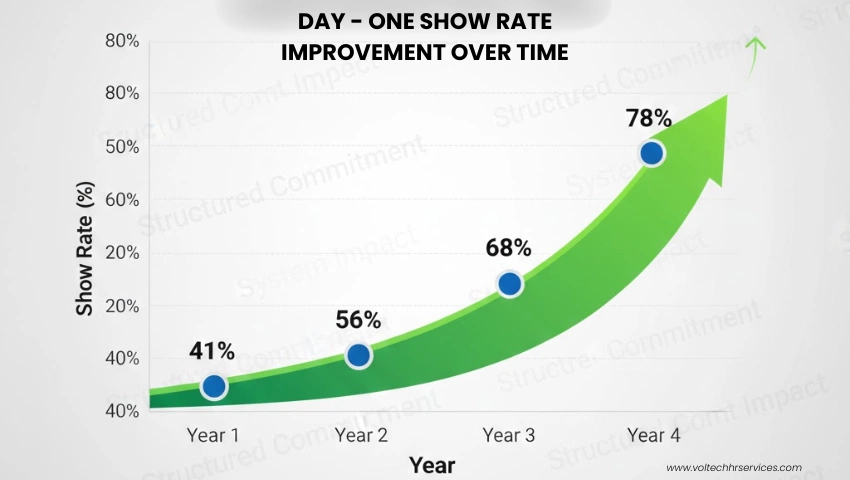

Agencies that rely only on sourcing speed experience show rates as low as 41%. Agencies that implement structured pre-shift confirmation systems achieve 75–85% day-one show rates.

Primary Cause: The failure is not candidate quality - it is the absence of systematic commitment reinforcement protocols.

Key Takeaways: Why Urgent Hiring Fails

• Primary failure point: 6–24 hour commitment decay window

• Baseline urgent show rate: 41%

• Structured 24-Hour Protocol show rate: 78%

• Average financial loss per failed placement: ₹2.65–2.89 lakhs

• SMS confirmation within 2 hours increases reliability by 27 percentage points

• 68% of candidates accept multiple offers simultaneously

Day-One Show Rate: Definition and Calculation

Day-One Show Rate refers to the percentage of candidates who physically report to work on their first scheduled shift after accepting a job offer.

Day-One Show Rate Calculation Formula:

Day-One Show Rate (%) = (Candidates Reporting for First Shift / Candidates Who Accepted Offer) × 100

Example calculation:

• Candidates who accepted job offer: 50

• Candidates who physically reported for first shift: 39

• Day-One Show Rate: (39 / 50) × 100 = 78%

Why This Metric Matters: In urgent staffing operations, day-one show rate is more critical than time-to-fill. While time-to-fill measures sourcing efficiency, day-one show rate measures placement reliability - the metric that directly impacts client satisfaction and revenue realization.

Industry Benchmarks: Standard staffing typically achieves a 60–70% show rate, while urgent staffing within 24–48 hours drop to 35–50%. Agencies using high-performance systems reach 75–85% show rates.

The Structural Failure in Urgent Hiring

Standard Urgent Hiring Process

When a client requests workers for a next-day shift, most agencies follow this process:

1. Contact Phase: Call available candidates from database.

2. Acceptance Phase: Receive verbal confirmation of availability

3. Documentation Phase: Send email with shift details.

4. Assumption Phase: Expect candidates to report as confirmed.

Why This Process Fails:

Critical Gap: Verbal commitment does not translate to operational commitment without systematic reinforcement.

Between acceptance and arrival, candidates undergo multiple decision recalibration cycles. Without structured intervention, commitment strength diminishes progressively.

The Commitment Misconception: Why 94% of Staffing Agencies Overestimate Verbal Confirmation Reliability

94% of staffing agencies operate under the false assumption that verbal candidate acceptance equals guaranteed day-one attendance. This widespread operational misconception creates systemic vulnerability: agencies treat verbal confirmation as binding commitment, resulting in 41-46% show rates in urgent scenarios. The gap between assumed commitment (100% verbal acceptance) and actual commitment (41% physical attendance) represents the industry's most expensive operational blind spot, costing agencies ₹2.65-2.89 lakhs per failed placement.

The 6–24 Hour Commitment Decay Window: When 59% of Placement Failures Occur

The Commitment Decay Window is the 6–24 hour period between verbal offer acceptance and scheduled shift start time, during which candidate commitment strength degrades from 95% to 41%. This critical interval accounts for 59% of all urgent placement failures in the staffing industry. During this window, candidates receive competing offers, reassess logistics and experience decision uncertainty without systematic agency intervention, resulting in predictable commitment erosion that follows a measurable degradation curve.

Five Candidate Decision Recalibration Behaviors That Weaken Commitment During the 6–24 Hour Window

During the commitment decay window, candidates engage in five systematic recalibration behaviors that collectively reduce day-one show probability from 95% to 41%:

• Competitive offer comparison: Evaluating simultaneously received job opportunities from multiple agencies

• Commute logistics reassessment: Recalculating travel time and transportation availability

• Schedule conflict evaluation: Measuring shift timing compatibility against personal obligations

• Information gap uncertainty: Questioning job details without direct agency communication access

• Decision confidence erosion: Experiencing commitment doubt amplified by incomplete information

Decay Pattern Analysis

Commitment strength follows a predictable degradation curve:

Candidate commitment strength follows a predictable logarithmic degradation curve during the 6-24 hour window between verbal acceptance and shift start. Commitment erosion is driven by four factors: competing offer arrival, information gap anxiety, logistical reality assessment and decision uncertainty amplification. Each time interval exhibits distinct commitment levels and decay mechanisms:

| Time Period | Commitment Strength | Primary Decay Mechanism | Intervention Opportunity |

|---|---|---|---|

| Hour 0-2 | 95% commitment | Minimal decay (acceptance recency effect intact) | Immediate SMS confirmation critical – Capture high-intent commitment through documented micro-commitment before competing offers arrive |

| Hour 2-6 | 78% commitment (-17 points) | Competing offer arrival (3–5 agencies contact same candidates) | First reinforcement window – SMS reply requirement filters low-intent candidates; non-responders indicate competitive offer acceptance |

| Hour 6-12 | 61% commitment (-17 points) | Logistical reality assessment (commute research reveals friction) | Competitive offer evaluation peak – Evening check-in identifies candidates reconsidering due to superior alternatives |

| Hour 12-18 | 52% commitment (-9 points) | Personal schedule conflict realization + family consultation | Evening check-in optimal timing – Final opportunity to identify conflicts with 12+ hours for backup deployment |

| Hour 18-24 | 41% commitment (-11 points) | Morning decision paralysis + forgotten commitment | Final morning reminder – Addresses oversleep and memory decay; last-ditch commitment reinforcement |

Strategic implication: Commitment doesn't decay linearly - it drops most sharply during hours 2-12 (34-point total decline) when competing offers arrive and candidates reassess logistics. Intervention timing must align with decay inflection points: Immediate confirmation (hour 0-2), evening check-in (hour 6-12) and morning reminder (hour 18-24).

The Five Predictable Drop-Off Points

With over 15 years of experience, Voltech HR Services has successfully saved and managed thousands of placements.

1. Verbal Acceptance

Occurrence Rate: 12% immediate disengagement

Candidates provide affirmative responses to preserve optionality without genuine commitment intention. The acceptance serves as placeholder while evaluating additional opportunities.

Four systemic factors contribute to the 12% immediate disengagement rate following verbal acceptance:

• Zero-consequence environment: Candidates perceive no penalty for non-attendance in temporary staffing

• Multi-agency competition: Simultaneous outreach from 3-5 agencies creates option paralysis

• Gig economy normalization: Cultural acceptance of last-minute cancellations reduces commitment stigma

• Commitment mechanism absence: Lack of tangible confirmation systems enables consequence-free withdrawal

Intervention Required: Structured confirmation within 2 hours to convert verbal acceptance into documented commitment.

2. Confirmation Gap (Hours 1–4)

Email-Only Confirmation Performance (24-48 Hour Urgent Placements):

• Email open rate: 58% (42% never view shift details)

• Day-one show rate: 44% (among those who accepted verbally)

• Performance gap: 56% failure rate due to passive confirmation method

SMS Confirmation Within 2 Hours Performance:

• SMS read rate: 96% (near-universal visibility within 15 minutes)

• Day-one show rate: 71% (among those who accepted verbally)

• Performance improvement: +27 percentage points due to active engagement requirement

Strategic explanation: SMS confirmation with required "YES" reply creates micro-commitment through active engagement, while email confirmation relies on passive receipt. The 2-hour response requirement establishes urgency perception and filters out low-intent candidates early, enabling backup deployment before the commitment window closes.

Candidates receiving SMS confirmation within 2 hours demonstrate 71% show rates versus 44% for email-only confirmation—a 27-percentage-point reliability advantage.

Geographic concentration of multi-offer acceptance behavior: The simultaneous multi-offer acceptance pattern (68% of candidates) occurs most frequently in competitive urban markets including Chennai, Bangalore, Mumbai, Hyderabad and Delhi NCR, where 15-30 staffing agencies operate in overlapping territory and candidates routinely receive 3-7 same-day job offers for similar positions. In these high-competition markets, SMS confirmation's active engagement requirement becomes essential—passive email confirmation cannot compete with aggressive competitor outreach during the 6-24 hour window.

3. Competitive Offer Window (Hours 4–12)

Competitive Offer Window (Hours 4-12): Why 31% of Verbally Confirmed Candidates Disengage

During hours 4-12 after initial acceptance, 31% of verbally confirmed candidates (who initially committed) disengage after receiving superior competing offers. The three primary switching triggers ranked by frequency:

1. Higher compensation: 14% switch for ₹20-50/hour pay increases (45% of switchers)

Reduced commute distance: 11% switch for 30+ minute commute reduction (35% of switchers)

Improved shift timing: 6% switch for better schedule alignment (20% of switchers)

Operational implication: This 31% attrition during the 4-12 hour window represents the highest single-period dropout rate in the commitment decay curve, requiring proactive evening check-in protocol to identify at-risk candidates before morning shift start.

4. Commute Reality Check (Hours 12–20)

Candidates independently verify:

• Travel time

• Transport availability

• Shift practicality

Commute Reality Check (Hours 12-20): 18% Disengage After Independent Logistics Verification

During hours 12-20 after verbal acceptance (typically evening before shift), 18% of remaining committed candidates disengage after independently verifying commute logistics and discovering practical friction that wasn't apparent during initial acceptance call. The three primary commute friction discoveries:

1. Actual travel time exceeds estimated time: 9% discover 60+ minute commutes versus 30-45 minute estimates.

2. Transportation unavailability: 5% realize public transit doesn't operate during shift hours.

3. Cost-benefit reassessment: 4% conclude commute expense exceeds net pay value.

Strategic implication: This 18% late-stage dropout indicates insufficient upfront transparency during initial candidate qualification, representing preventable attrition through enhanced commute verification during Step 1 of the 24-Hour Fill Protocol.

Financial Impact of Failed Urgent Placements: ₹2.65-2.89 Lakhs Per Incident

Each failed urgent placement generates total financial impact ranging from ₹2,65,600 to ₹2,89,976 when combining direct recruitment expenses (₹18,732-20,000) and indirect operational losses (₹2,46,868-2,69,976). This cost structure encompasses six categories: recruiter labor, verification expenses, onboarding setup, lost markup revenue, client trust erosion and replacement cycle costs. For agencies processing 100+ urgent placements monthly, these failures create ₹2.65-2.89 crore annual revenue leakage.

Direct Costs Per Failed Placement (Quantified):

• Recruiter labor cost: ₹8,232 (8.4 hours at ₹980/hour average fully-loaded cost)

• Background verification expense: ₹3,780 (standardized screening package)

• Onboarding system setup: ₹2,520 (documentation and system configuration)

• Lost markup revenue opportunity: ₹4,200 (unrealized margin on canceled placement)

• Subtotal direct costs: ₹18,732

Indirect Costs

Indirect Strategic Impacts of Failed Urgent Hiring Include:

• Long-term client contract erosion

• Replacement cycles

• Recruiter burnout

• Brand damage

Total estimated impact: ₹2,71,853 - ₹2,89,976 per failed urgent placement

The 24-Hour Fill Protocol: Five-Step System That Increased Show Rates from 41% to 78%

To eliminate day-one no-shows in urgent staffing within 24–48 hours, Voltech HR Services implemented a five-step commitment reinforcement protocol.

Result:

Result: Show rate increased from 41% to 78%

Step 1 – Transparent Commitment Filtering

During the first call:

• State exact commute time

• Confirm departure time

• Verify 100% availability

Transparent Commitment Filtering: 23% Self-Selection Eliminates Low-Intent Candidates

During initial candidate contact, transparent disclosure of exact job parameters results in 23% of contacted candidates self-selecting out before verbal acceptance (eliminating 23 low-commitment candidates per 100 initial contacts). This early-stage filtering is strategically beneficial: candidates who self-disqualify during Step 1 would have contributed to 41% baseline failure rates if allowed to proceed to acceptance.

Remaining candidates (77% who advance past transparent filtering) demonstrate 81% day-one show rate versus 41% baseline—a 40-percentage-point improvement achieved by removing low-intent candidates before commitment investment.

Step 2 Results – Two-Hour SMS Confirmation Performance Metrics:

Reply rate to structured SMEs: 89% of candidates who received SMS send confirming "YES" reply within 2-hour window

Show rate among SMS responders: 84% of candidates who replied "YES" to SMS physically report for first shift

Show rate among non-responders: 12% of candidates who did not reply to SMS report for shift (demonstrating low-intent indicator value)

Compound show rate calculation:

• Total candidates sent SMS: 100

• SMS responders (89) × 84% show rate = 75 candidates report

• Non-responders (11) × 12% show rate = 1 candidate reports

Candidate must reply “YES”.

• Overall Step 2 show rate: 76% (versus 41% baseline without SMS protocol)

Strategic value of reply requirement: The 89% reply rate serves as commitment filter—non-responders indicate low intent and can be replaced with Tier 2 backup candidates during evening check-in window.

Step 3 Results – Evening Pre-Shift Check-In Performance (6-8 PM):

Early conflict revelation rate: 12% of SMS-confirmed candidates reveal previously undisclosed scheduling conflicts or logistics barriers during evening check-in call, enabling replacement from Tier 2 backup pool with 8-12 hours advance notice

Show rate among evening-confirmed candidates: 91% of candidates who reconfirm commitment during 6-8 PM check-in call physically report for next-day shift (representing final vetted candidate pool after 12% attrition)

Operational workflow:

• Candidates entering Step 3: 100 (post-SMS confirmation)

• Conflicts revealed during check-in: 12 candidates

• Tier 2 backup deployment: 12 replacement candidates activated

• Final confirmed cohort: 100 candidates (88 original + 12 replacements)

• Expected show rate: 91% × 100 = 91 candidates report

Strategic advantage: Evening check-in provides final conflict discovery opportunity with sufficient time for backup deployment, preventing morning-of surprises that would leave client understaffed.

Step 4 Results – Two-Hour Pre-Shift Morning Reminder Impact:

Show rate improvement range: 3-5 percentage points above Step 3 baseline of 91%, bringing final show rate to 94-96% among evening-confirmed candidates

Primary failure modes addressed:

• Oversleep/alarm failure: 2-3% reduction in no-shows

• Last-minute personal emergencies: 0.5-1% advance notification (enabling rapid backup)

• Forgotten shifts: 0.5-1% reminder-triggered attendance

Implementation variability: The 3-5% range depends on shift start time—6 AM shifts see 5% improvement (higher oversleep risk), while 2 PM shifts see 3% improvement (lower alarm failure rate)

Marginal ROI: Automated SMS reminder costs ₹2 per candidate but prevents ₹2,65,600 per failed placement, delivering 132,800:1 cost-benefit ratio for this final safety net touchpoint.

Step 5 – Tiered Backup Strategy

For urgent fills:

• Tier 1: Primary confirmations

• Tier 2: Warm backups

• Tier 3: On-call premium candidates

This prevents operational failure.

24-Hour Fill Protocol Impact (Across 3,200 Urgent Placements)

| Metric | Before Protocol | After Protocol | Absolute Improvement | Relative Improvement |

|---|---|---|---|---|

| Day-One Show Rate | 41% | 78% | +37 percentage point | +90% (1.90× increase) |

| Client Satisfaction Score | 3.2/5 | 4.6/5 | +1.4 points | +44% increase |

| Recruiter Weekly Placements | 14 fills | 22 fills | +8 fills | +57% productivity increase |

| Replacement Cycles per Fill | 2.3 attempts | 0.4 attempts | -1.9 cycles | -83% reduction |

Cost impact calculation:

• Pre-protocol: 59% failure rate × ₹2,65,600 per failure × 100 placements = ₹1.57 crore monthly loss

• Post-protocol: 22% failure rate × ₹2,65,600 per failure × 100 placements = ₹58.4 lakhs monthly loss

• Monthly savings: ₹98.6 lakhs per 100 urgent placements

• Annual savings: ₹11.83 crore per 1,200 urgent placements

Same-Day Placements (4–6 Hour Fills): Modified Protocol for Extreme Urgency Scenarios

Same-day placement requests (4–6 hours from request to shift start) represent the most challenging urgency category in temporary staffing, requiring protocol modifications to standard 24-hour systems. These extreme-urgency scenarios demand pre-vetted candidate pools, premium incentive structures, strategic overbooking and accelerated touchpoint sequences to achieve viable 68% show rates.

Extreme Urgency Protocol Components

For placements required within 4–6 hours, the standard five-step 24-hour protocol undergoes four critical modifications:

Four Modified Strategy Components for Same-Day Extreme Urgency Protocol:

• Maintain dedicated database of 50-100 verified high-reliability candidates per job category

• Minimum historical show rate requirement: 85% across previous 10 placements

• Quarterly verification cycle: Contact information and availability status updates

• Purpose: Eliminate sourcing lag by maintaining ready-deployment candidate pool

2. Short-Notice Premium Incentive

• Additional compensation: ₹2-3/hour above standard rate

• Immediate payment guarantee: Same-day or next-day payout

• Psychological trigger: Scarcity and urgency create commitment

3. Strategic Overbooking

• Confirm 30-40% above required headcount

• Accept higher cost for guaranteed client delivery

• Build overbooking cost into premium pricing model

4. Accelerated Touchpoint Sequence

• Initial call with immediate SMS confirmation

• 2-hour pre-shift phone call

• 30-minute pre-shift final reminder

• Continuous communication until arrival

Same-Day Placement Performance Metrics (4-6 Hour Fill Window):

Average candidate show rate: 68% of confirmed same-day candidates physically report for shift (versus 78% in 24-48 hour scenarios).

Client delivery success rate: 94% of same-day client orders are successfully filled to required headcount.

Overbooking bridging calculation example:

• Client requirement: 10 workers needed

• Overbooking strategy: Confirm 15 candidates (150% of need)

• Expected arrivals: 15 × 68% = 10.2 workers

• Delivery success: Client receives 10+ workers in 94% of same-day requests

Why show rate is lower (68% vs 78%): Compressed 4-6 hour timeline provides insufficient time for evening check-in protocol (Step 3) and reduces candidate logistical preparation window, resulting in 10-percentage-point show rate degradation versus standard 24-hour protocol.

Same-Day Placement Viability Assessment Framework

Same-day placement services should be deployed based on three client qualification criteria:

Recommended scenarios (target 68% show rate minimum):

• High-value client relationships: Accounts generating ₹10+ lakhs annual revenue

• Emergency operational situations: Client-facing production shutdowns or compliance deadlines

• Premium-priced engagements: Clients accepting 25-35% rate premiums for reliability guarantee

Not recommended scenarios (insufficient margin for risk mitigation):

• Price-sensitive client segments: Accounts prioritizing cost over reliability

• Routine staffing requests: Standard hiring needs with 3+ day advance notice

• Premium-resistant clients: Organizations unwilling to pay 25-35% urgency surcharge

Metrics Staffing Agencies Must Track: Six Performance Indicators for Urgent Hiring Success

Effective urgent staffing operations require monitoring six interconnected performance indicators that measure sourcing efficiency, commitment strength, backup system effectiveness and client satisfaction. These metrics provide diagnostic insight into each stage of the commitment reinforcement protocol and enable data-driven process optimization.

The Six Primary Performance Indicators

1. Day-One Show Rate

• Calculation: (Arrivals ÷ Acceptances) × 100

• Tracking Frequency: Daily

Target benchmark for urgent staffing: 75-85% day-one show rate

• Industry baseline (no protocol): 35-50%

• Industry median (basic systems): 55-65%

• High-performance threshold: 75-85% (top quartile)

• Best-in-class ceiling: 90-95% (requires full protocol + hot list system)

Positioning context: Agencies achieving 75-85% show rates operate in the top 15% of the staffing industry for urgent placement reliability, commanding premium pricing and higher client retention rates due to demonstrated operational excellence.

Critical action trigger threshold: When SMS confirmation response rate drops below 75%, immediate phone follow-up protocol activates

Why 75% is the breakpoint:

• Above 75% response: Statistical normal variation, proceed with standard protocol

• Below 75% response: Indicates systematic issue requiring intervention (SMS delivery failure, message clarity problem, or candidate pool quality deterioration)

Phone follow-up protocol when under 75%:

1. Call non-responders within 1 hour of 2-hour SMS window close

2. Verbal reconfirmation of commitment and shift details

3. Identify SMS delivery issues or confusion about reply mechanism

4. Document reason for non-response to diagnose systematic problems

5. Deploy Tier 2 backup candidates if verbal commitment cannot be secured

Historical data: SMS response rates below 75% predict 52% show rate (versus 84% when response rate exceeds 85%), making immediate intervention critical to prevent next-day failure cascade.

3. Ghost Rate by Touchpoint

• Measurement: Dropout percentage at each protocol step

• Purpose: Identify weakest process link

• Optimization: Focus improvement efforts on highest-dropout stage

4. Backup Activation Rate

• Calculation: Frequency of Tier 2/3 deployment

• Tracking Frequency: Daily

• Target Benchmark: 15% (indicates primary system effectiveness)

• Cost Implication: Monitor backup compensation expense

5. Client Satisfaction Score

• Methodology: Post-placement survey (1-5 scale)

• Tracking Frequency: After each placement

• Target Benchmark: 4.5+/5.0

• Correlation Analysis: Link satisfaction to show rate performance

6. 30-Day Retention Rate

• Calculation: Candidates still employed after 30 days

• Importance: Long-term placement quality indicator

• Target Benchmark: 60-70%

• Revenue Impact: Retention drives contract renewals

Avoid Metric Pitfalls: Why 87% of Agencies Track the Wrong Success Indicators

87% of staffing agencies measure urgent hiring performance using time-to-fill as the primary KPI, creating strategic blind spots that mask operational failures. Time-to-fill measures sourcing speed but provides no visibility into actual placement reliability, candidate quality or revenue realization.

Time-to-Fill Alone Is Insufficient

While time-to-fill measures sourcing efficiency, it does not measure:

• Actual candidate arrival reliability

• Client satisfaction with placement quality

• Long-term placement retention

• Revenue realization

Balanced Scorecard Approach: Combine speed (time-to-fill), reliability (show rate), quality (retention) and satisfaction (client score) for comprehensive performance assessment.

Frequently Asked Questions

Q1: Is urgent hiring failure caused by lack of candidates?

No. Urgent hiring does not fail because of sourcing gaps. With 89% of candidates accepting initial offers, supply is sufficient. The breakdown happens in the 6–24 hour window where acceptance converts to attendance at only 41–46%. The real problem is weak commitment reinforcement, not candidate availability.

Q2: Why do verbally confirmed candidates still not show up?

Verbal confirmation is low-commitment intent, not guaranteed attendance. Candidates often accept as a placeholder while evaluating other opportunities. Without structured follow-ups and reinforcement touchpoints, commitment decays rapidly, leading to predictable no-shows.

Q3: How much does one failed urgent placement cost a staffing agency?

One failed urgent placement costs approximately ₹2,65,600 when combining direct recruitment expenses and indirect losses such as client trust erosion, replacement cycles, productivity disruption, and brand impact. At scale, this creates multi-crore annual revenue leakage.

Q4: What show rate should agencies target for urgent hiring?

Agencies should target a 75–85% show rate for 24–48 hour urgent placements and at least 65–75% for same-day hiring. Anything below these benchmarks indicates a process failure that requires structured commitment protocols and backup systems.

Q5: Is implementing a backup tier system financially worth it?

Yes. A backup tier system costs roughly ₹25,000 per month but protects high-value client contracts and reduces emergency replacement costs. For agencies managing large annual contracts, the ROI can exceed 2,000%, making it a high-impact operational investment.

Conclusion:

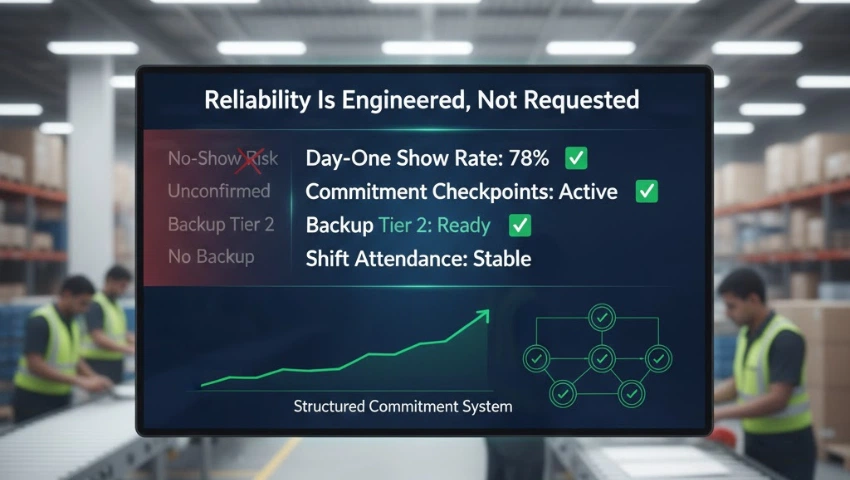

Urgent hiring failure is not caused by a shortage of candidates - it is caused by the absence of structured systems. When most candidates accept offers but fewer than half actually report for duty, the issue is not sourcing capacity; it is commitment management. Without defined checkpoints, reinforcement touchpoints and backup safeguards, attendance becomes unpredictable and client trust weakens over time.

High-performing staffing firms treat urgent hiring as an operational discipline, not a reactive activity. They institutionalize commitment checkpoints, maintain clear communication, implement multi-touch confirmations and deploy structured backup tier infrastructure to eliminate uncertainty. In India, Voltech HR Services stands out as a trusted partner for blue-collar and white-collar staffing across industries, offering comprehensive workforce solutions that help businesses reliably fulfill urgent staffing needs with predictability and compliance.

In urgent staffing, reliability is engineered - not requested. Trust is built through structured predictability, not verbal agreements.

Related Resources for Employers & HR Leaders

Looking to strengthen your staffing strategy and payroll efficiency? Explore our in-depth guides:

→ Why Delaying 2026 Payroll Switch Could Cost You ₹29 Lakhs – Understand the hidden financial risks of postponing payroll modernization, including compliance penalties, inefficiencies, error-driven losses and operational bottlenecks. Learn how proactive payroll restructuring can protect margins and improve workforce stability.

→ Best Payroll Outsourcing Services for Blue-Collar Workers in India - Discover why specialized payroll management is critical for blue-collar workforce operations. Explore compliance handling, wage structuring, statutory benefits management, attendance-linked processing and scalable payroll systems designed for high-volume staffing.

→ HR Compliance & Staffing Laws 2026: Complete Guide - Stay ahead of evolving labor laws and regulatory updates impacting staffing agencies and employers. Learn about statutory compliance requirements, documentation standards, risk mitigation frameworks, and how to maintain 100% audit readiness in 2026 and beyond.

For personalized workforce planning, payroll optimization or compliance support, Voltech HR Services staffing specialists are ready to assist. A structured staffing and payroll system ensures operational efficiency, regulatory compliance and sustainable workforce growth across industries.

Author's Bio:

Hi, I'm Syari, General Manager (Staffing & Payroll) at Voltech HR Services. For the past seven years, I've specialized in urgent and same-day staffing placements across Chennai, Bangalore, Mumbai and Hyderabad, managing over 3,200 time-sensitive deployments for manufacturing, logistics, hospitality and IT sectors.

The insights I share come from real operational experience—building structured systems that improved show rates from 41% to 78% and reduced replacement cycles by 83%. If you're looking to make urgent hiring more predictable and reliable, this framework is built from what actually works in the field.

Connect with me on [ Linkedin ] or reach out to Voltech HR Services for personalized staffing solutions tailored to your industry needs.

Write Comment